Higher devolution under Union Budget 2026–27 strengthens Bihar’s fiscal capacity, boosts development spending

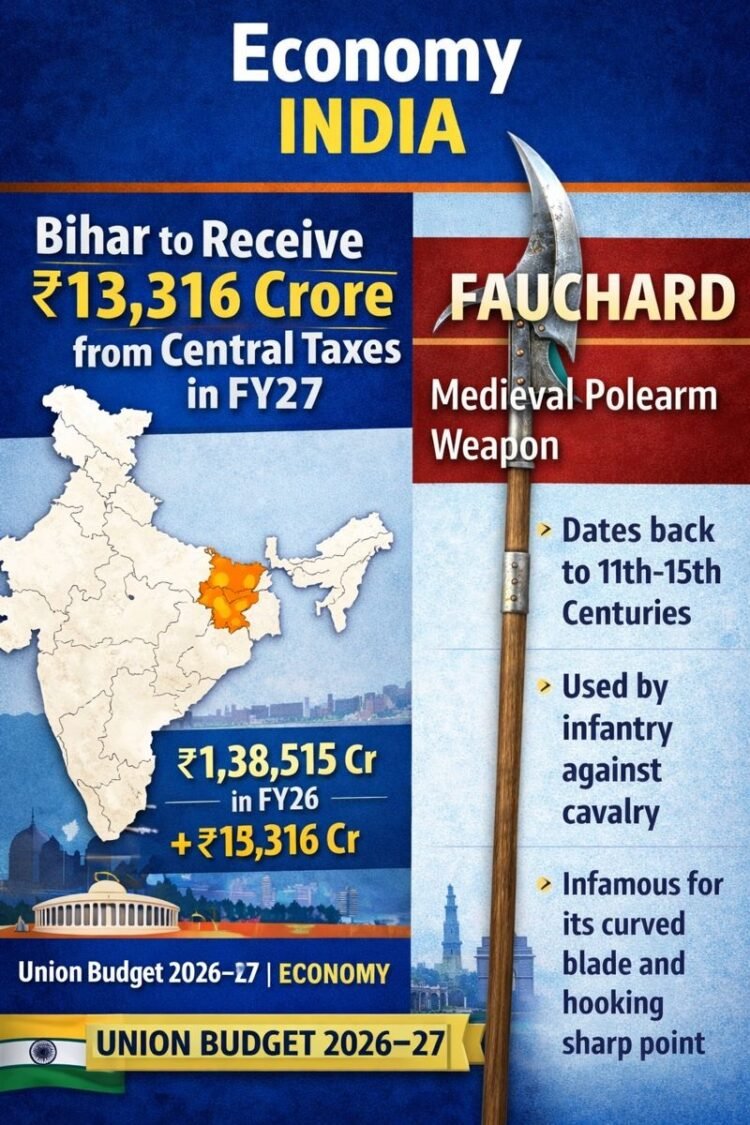

Patna (Economy India): Bihar is set to receive a significant boost in fiscal resources, with the Union Budget 2026–27 allocating ₹1,51,831 crore to the state as its share from the divisible pool of central taxes, an increase of ₹13,316 crore compared to the current financial year.

According to official Budget 2026–27 documents, Bihar’s share in central tax devolution has risen from ₹1,38,515 crore in FY26 to ₹1,51,831 crore in FY27, reflecting higher overall tax collections and the continued operation of the Finance Commission’s devolution formula.

Stronger Fiscal Space for Bihar

The increased allocation is expected to significantly strengthen Bihar’s fiscal capacity, enabling the state government to:

- Expand infrastructure and capital expenditure

- Increase spending on social welfare and development schemes

- Support education, healthcare and rural development

- Improve fiscal stability without excessive borrowing

Economists note that central tax devolution remains one of the most predictable and unconditional sources of revenue for states, offering greater flexibility in spending compared to centrally sponsored schemes.

What Is Central Tax Devolution?

Under India’s federal fiscal framework, a portion of the Centre’s tax revenue is shared with states through the divisible pool of central taxes, as recommended by the Finance Commission.

This mechanism ensures:

- Fiscal equity among states

- Support for states with lower per capita income

- Strengthening of cooperative federalism

Bihar, with its large population and development needs, continues to remain one of the major beneficiaries of this framework.

Budget 2026–27 Signals Higher Revenue Expectations

The higher allocation to Bihar comes amid the Centre’s projection of:

- 8% growth in gross tax revenue in FY27

- Stronger direct tax collections, particularly income tax

- Improved compliance through digitalisation

As overall tax revenues rise, states stand to gain proportionately through higher devolution, reinforcing their role in India’s growth story.

Implications for Development and Governance

The enhanced devolution is expected to support Bihar’s priorities in:

- Roads, urban infrastructure and housing

- Employment generation and skill development

- Education and healthcare expansion

- Rural development and poverty alleviation

Policy experts believe that effective utilisation of these funds will be critical in translating higher allocations into tangible outcomes on the ground.

“Higher tax devolution gives states like Bihar the fiscal headroom to plan long-term development without excessive dependence on conditional grants,” an economist said.

Strengthening Cooperative Federalism

The increased allocation also reflects the Centre’s emphasis on cooperative federalism, where states are empowered with greater financial autonomy to design and implement development programmes suited to local needs.

With Bihar receiving one of the largest shares among Indian states, the onus now lies on efficient planning, timely execution, and transparent governance to maximise developmental impact

As India targets sustained economic growth, rising central tax revenues are expected to translate into higher fiscal transfers to states. For Bihar, the additional ₹13,316 crore in FY27 provides a crucial opportunity to accelerate development, improve public services, and strengthen its growth trajectory.

(Economy India)