Industrial credit growth slowed to 7.3% in September 2025, from 8.9% a year earlier.

Mumbai (Economy India): Industrial credit growth in India slowed to 7.3% in September 2025, down from 8.9% in the corresponding month last year, according to the latest data released by the Reserve Bank of India (RBI) on Friday.

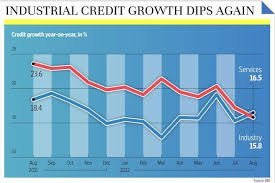

The decline highlights a period of moderation in industrial loan demand amid tight financial conditions, sluggish private investment, and a shift in bank lending priorities toward retail and services segments.

Industrial Lending Faces Slowdown Despite Economic Growth

While India’s GDP has continued to grow at a steady pace, the credit flow to industries has not kept up. The RBI’s data on sectoral deployment of bank credit revealed that lending to sectors such as infrastructure, basic metals, chemicals, and textiles saw a slower expansion compared to last year.

Economists believe the decline signals a cautious lending environment following elevated interest rates and increased scrutiny on asset quality.

“High interest costs and delayed investment decisions have led to muted credit demand from large corporates,” said Anindita Bhattacharya, senior economist at a leading financial institution.

“Banks have turned more selective in industrial lending, preferring sectors with lower risk and higher profitability such as retail, housing, and services,” she added.

Segment-Wise Performance: Large Industries Lag Behind

The data showed that large industries—which account for nearly 80% of industrial credit—recorded the sharpest moderation in borrowing. Credit to large industries rose by just 6.5% year-on-year, compared with 8.4% during the same period last year.

In contrast, micro, small, and medium enterprises (MSMEs) continued to receive steady credit support through government-backed guarantee schemes, priority sector lending targets, and ECLGS-linked loans.

However, bankers note that even within MSMEs, repayment stress is gradually building due to higher financing costs and delayed payments from large buyers.

Infrastructure and Metal Sectors Record Lower Demand

The infrastructure sector, which typically drives industrial loan growth, also saw a slowdown. Bank credit to infrastructure expanded 7.1% in September, compared to 9.2% a year ago, as several large projects reached completion phases and new approvals remained limited.

Similarly, the basic metals and mining sector saw credit growth dip to 6.8%, reflecting lower capital expenditure and cautious capacity expansion amid global demand uncertainty.

Textile, cement, and chemical sectors also reported weaker credit offtake, suggesting that the industrial recovery remains uneven across sub-sectors.

📘 RBI Credit Data Snapshot – September 2025

| Category | Growth (%) |

|---|---|

| Overall Bank Credit | 14.9 |

| Industrial Credit | 7.3 |

| Retail Credit | 16.4 |

| Services Credit | 13.8 |

| Agriculture | 10.7 |

Caption:

Retail and services continue to outpace industrial credit in FY25.

Retail and Services Drive Overall Bank Credit

Interestingly, while industrial lending weakened, overall non-food bank credit in the economy continued to grow at a healthy 14.9% year-on-year, driven primarily by personal loans, housing, and services sectors.

RBI data showed that retail credit, including home, vehicle, and consumer loans, expanded at a double-digit pace, contributing over 40% of total incremental lending in the past year.

This shift in lending mix reflects a structural trend among banks to focus on low-risk, high-yield segments amid volatile global economic conditions.

Economists Expect Revival in FY26

Analysts expect industrial credit growth to pick up gradually in FY26, supported by lower inflation, potential policy easing by the RBI, and continued government capital expenditure.

“As inflation moderates and the central bank transitions towards a neutral or accommodative stance, borrowing costs will come down,” said Rajesh Malhotra, Chief Economist, India Ratings & Research.

“This, coupled with the government’s infrastructure pipeline and PLI-linked manufacturing investments, should revive corporate credit demand in the next two to three quarters,” he noted.

Monetary Policy and Investment Outlook

The RBI’s Monetary Policy Committee (MPC) has maintained the repo rate at 6.50% since February 2024 to control inflation, but this prolonged high-interest environment has raised borrowing costs for industries.

Private investment growth, which was expected to accelerate in FY25, has instead remained subdued due to global economic uncertainties and geopolitical risks impacting export-oriented sectors.

Experts suggest that India’s industrial loan growth trajectory will depend on how quickly private sector confidence returns and whether banks recalibrate their lending strategies to support productive capital formation.

A Transitional Phase for Industrial Lending

The moderation in industrial credit growth to 7.3% in September points to a transitional phase in India’s economic cycle — where robust consumer demand contrasts with restrained industrial borrowing.

While short-term challenges remain, economists view this as a temporary pause before the next cycle of investment-led growth begins, particularly if policy support and liquidity conditions improve in early FY26.

(Economy India)