In a strategic move to strengthen investor confidence and improve stock liquidity, Patanjali Foods has approved a 2:1 bonus share issue, signaling robust financial health and long-term growth commitment.

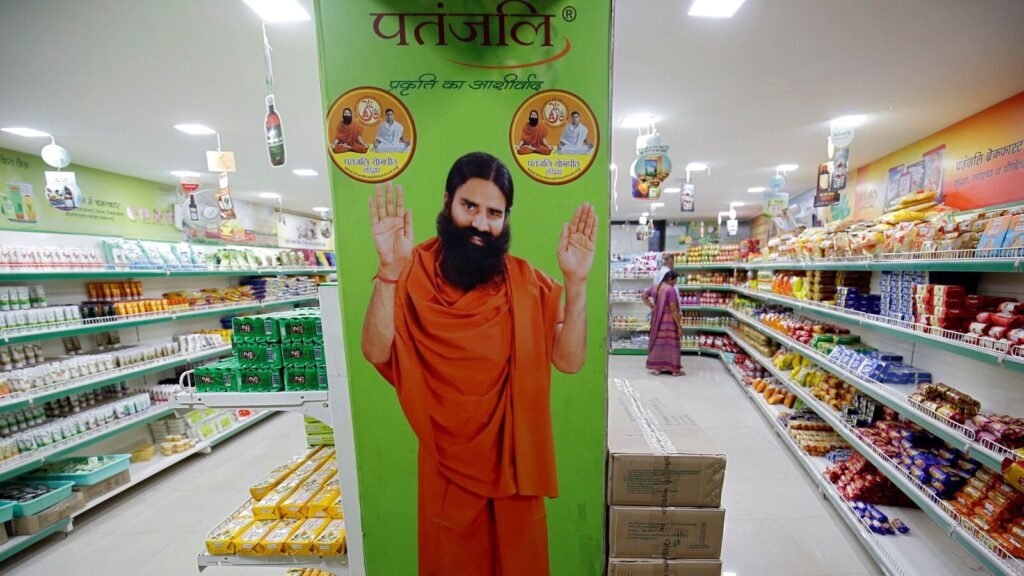

📌 New Delhi (Economy India): Patanjali Foods Ltd., one of India’s leading FMCG and edible oil conglomerates backed by yoga guru Baba Ramdev, has approved the issuance of bonus shares in the ratio of 2:1 — granting one additional equity share for every two shares held. The announcement was made after the company’s board meeting on Thursday and has been viewed as a significant gesture of shareholder reward and corporate strength.

✅ What the Bonus Share Issue Means

Under the approved scheme, eligible shareholders will receive one free equity share for every two existing shares, with a face value of ₹2 per share. This is the first-ever bonus issue by Patanjali Foods, marking a historic corporate action by the company since its transition from Ruchi Soya to a Patanjali-backed enterprise.

The company informed stock exchanges that the record date to determine eligible shareholders will be announced shortly. The credited bonus shares will be reflected in shareholders’ demat accounts by September 16, 2025.

📈 Stock Market Reaction: 7-Day Rally, RSI Crosses 77

The stock of Patanjali Foods reacted positively to the development. It witnessed an 11.4% surge over the last seven trading sessions, with Thursday’s trading volume clocking in at 2.8x the 30-day average. The Relative Strength Index (RSI) reached 77, pushing the stock into the overbought zone, indicating strong investor interest.

Over the past 12 months, the stock has returned 20%, and 5% year-to-date, outperforming many FMCG peers. Analysts say the momentum could continue with this bonus issue adding further liquidity to the counter.

💼 Strategic Significance of the Bonus Issue

The bonus issue reflects not only the company’s strong reserves and confidence in future earnings, but also its desire to democratize shareholding, making the stock more affordable for retail investors.

By enhancing liquidity, the bonus shares could pave the way for greater retail and institutional participation, especially as the company eyes further expansion in India’s growing health and wellness space.

A senior company spokesperson stated,

“This bonus issue is our way of recognizing the support of our over 2 lakh shareholders. It underlines our strong balance sheet and long-term value creation philosophy.”

📊 Analyst Views: Bullish Outlook Remains Intact

According to Bloomberg data, all four analysts tracking Patanjali Foods currently have a ‘Buy’ recommendation on the stock. The 12-month consensus price target is ₹2,101 — implying an upside potential of around 13% from current levels.

Analysts cite the company’s diversified product portfolio, expansion into nutraceuticals and plant-based foods, and brand loyalty as strong fundamentals supporting future growth.

📦 Business Performance: Solid Fundamentals Support the Move

Patanjali Foods has diversified across multiple consumer categories including edible oils, packaged foods, nutraceuticals, and personal care products. Its synergy with Patanjali Ayurved has helped the brand penetrate rural markets and leverage health-conscious consumer trends.

Despite intense FMCG sector competition, the company has maintained healthy margins, improved its distribution network, and focused on debt reduction and operational efficiencies.

📌 Key Highlights of the Bonus Share Announcement

| Particulars | Details |

|---|---|

| Bonus Ratio | 2:1 (1 bonus share for every 2 held) |

| Face Value of Bonus Share | Rs2 per share |

| Record Date | To be announced |

| Bonus Share Credit Date | On or before 16 September 2025 |

| First-Ever Bonus by Company | Yes |

| Beneficiaries | Over 2 lakh shareholders |

| Impact on Share Price | Adjusted post bonus issue |

| Purpose | Shareholder reward, increase liquidity |

📚 What is a Bonus Share Issue?

A bonus share issue is when a company allocates free additional shares to its existing shareholders using its free reserves or retained earnings. Though the price per share drops post bonus, the overall value of shareholding remains the same. It doesn’t dilute ownership but helps improve market participation.

🧠 Investor Perspective: What Should Shareholders Do?

Investors should keep an eye on the record date announcement. Those holding the shares as of the record date will automatically receive bonus shares. The post-bonus price correction is normal, and the increase in the number of shares held often enhances liquidity and trading volume.

Long-term investors, particularly those bullish on the FMCG and Ayurvedic segments, may view this as a positive sign of corporate confidence.

📢 A Shareholder-Centric Growth Story

With this bonus issue, Patanjali Foods has once again highlighted its focus on value creation, financial prudence, and retail inclusiveness. At a time when many companies are struggling with growth and margins, Patanjali’s shareholder-first approach could set it apart as a model of sustainable and inclusive corporate governance.

As India’s FMCG and health food sector expands, Patanjali Foods appears firmly positioned to grow — and grow with its investors.

(Economy India)