Trump claims the U.S. has earned billions through tariffs and vows to distribute the gains among citizens — experts question the legality, feasibility, and long-term impact on the American economy.

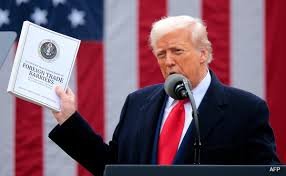

Washington D.C. (By Economy India): U.S. President Donald Trump on Sunday unveiled one of the most controversial economic promises of his tenure, announcing a $2,000 (approximately ₹1.7 lakh) cash payout for every low-income American. Trump claimed the funds would come directly from the “billions” generated through tariffs imposed on foreign countries — a policy cornerstone of his aggressive trade strategy.

Posting on his social platform Truth Social, Trump wrote that “tariffs have made America the richest and most respected nation on Earth,” and lashed out at critics calling them “fools” for opposing his economic policies.

“Tariffs are the reason businesses are returning to America,” Trump said. “Our government is earning more than ever before, and now it’s time to return that money to the people who built this country.”

The statement, however, lacked specifics — there was no clarity on the income threshold, disbursement mechanism, or timeline. Yet, the announcement has already shaken financial and political circles across the U.S., with economists warning that such populist moves could deepen the country’s already historic fiscal deficit.

Trump’s Tariff Policy: Populism or Protectionism?

Since taking office in January 2025, Trump has revived his hardline “America First” trade doctrine, imposing 10% to 50% tariffs on goods from over 100 countries — including major economies such as China, India, Mexico, and Canada. The administration argued that these tariffs would protect American manufacturing, correct trade imbalances, and generate new federal revenue.

In a fiery follow-up post, Trump expressed anger over what he described as “legal restrictions” on presidential powers to control trade, saying that U.S. presidents can “halt foreign trade in emergencies but cannot levy tariffs freely.”

“Other countries impose tariffs on us all the time,” he argued. “If we don’t do the same, we’ll lose everything. Tariffs are America’s defense — without them, we are powerless.”

Trump’s trade order issued in April 2025 led to a wave of retaliation, with several countries, including China and the European Union, announcing counter-tariffs on U.S. exports. Yet Trump continues to maintain that these tariffs have brought “unprecedented profits” to U.S. coffers.

Supreme Court Pushback: A Constitutional Clash

Trump’s policy has not gone unchallenged. On November 5, 2025, the U.S. Supreme Court ruled that most of Trump’s new tariffs were unconstitutional, asserting that “the power to tax and impose duties lies with Congress, not the President.”

Justice Sonia Sotomayor, delivering the majority opinion, noted that Trump’s invocation of the International Emergency Economic Powers Act (IEEPA) of 1977 did not grant him authority to levy tariffs without legislative approval.

Despite this, the Trump administration insists that the tariffs are vital to national security, arguing that global trade imbalances threaten the economic sovereignty of the United States.

Fiscal Reality: Massive Debt Overshadows Tariff Profits

According to the U.S. Treasury Department, tariff collections in fiscal year 2025 amounted to only $195 billion, far below the $500 billion estimated cost of distributing $2,000 to roughly 250 million non-wealthy Americans.

The U.S. national debt currently stands at an all-time high of $38 trillion (₹3,200 lakh crore) — exceeding 120% of the nation’s GDP. Interest payments alone now cost the U.S. government more than $1 trillion annually.

The New York Times reported that rather than reducing debt, Trump’s proposed “tariff dividend” could increase borrowing needs, potentially triggering inflation and market volatility.

“The math doesn’t add up,” said Dr. Evelyn Moore, senior economist at the Brookings Institution. “Tariff revenues are a fraction of what’s needed to fund such payouts. This is fiscal populism that risks long-term economic stability.”

Treasury and Market Reactions: Cautious Optimism, Underlying Concerns

U.S. Treasury Secretary Scott Bessent, in an interview with ABC News, clarified that no formal discussions had taken place regarding direct cash transfers.

“Our primary focus is on debt reduction, not new spending,” Bessent said. “Any relief would likely come in the form of tax credits, not checks.”

However, the administration continues to defend its protectionist agenda. Trump aides argue that tariffs have incentivized companies to reshore manufacturing, reduce dependency on Chinese imports, and strengthen domestic job creation — though economists remain divided on these claims.

On Wall Street, the markets reacted cautiously. The Dow Jones Industrial Average fell slightly by 0.3% amid concerns over increased government expenditure and fiscal uncertainty. Technology and manufacturing stocks, especially those with global exposure, saw minor declines.

Global Impact: Ripple Effects on Trade Partners

Trump’s aggressive tariff policy has already strained diplomatic and economic ties with several key U.S. allies. India, which now faces a 50% combined tariff (including penalties on Russian oil purchases), has termed the move “economically discriminatory.”

Analysts warn that such protectionist measures could push major economies to explore alternative trade blocs, bypassing U.S. markets altogether. The European Union and China have both signaled plans to file new WTO complaints against the U.S. over tariff violations.

“If the U.S. continues down this path, it risks isolating itself economically,” said Professor Mark Ellison of Harvard Kennedy School. “Protectionism might win votes, but it erodes global leadership.”

Political Angle: Populism Ahead of the 2026 Midterms

Political observers view Trump’s $2,000 promise as a strategic populist move ahead of the 2026 midterm elections, aimed at bolstering support among low- and middle-income voters. The announcement also mirrors earlier Trump-era tactics — such as the 2020 stimulus checks — that helped fuel short-term consumer confidence.

Polls conducted by Politico-Morning Consult after the announcement show that 62% of Republican voters support the idea of a tariff-funded dividend, while 70% of Democrats dismiss it as unrealistic.

A Risky Economic Bet

Trump’s $2,000 “tariff dividend” plan has reignited the global debate over trade protectionism versus fiscal responsibility. While the proposal resonates emotionally with working-class Americans facing inflation and wage stagnation, experts warn it could widen fiscal deficits, deepen trade rifts, and test the limits of presidential authority.

If implemented, the plan would mark one of the most audacious redistributive experiments in modern U.S. history — a blend of economic nationalism and populist ambition that could either redefine American capitalism or destabilize it further.

(Economy India)