Private consumption and investment emerge as key growth drivers in the latest GDP figures

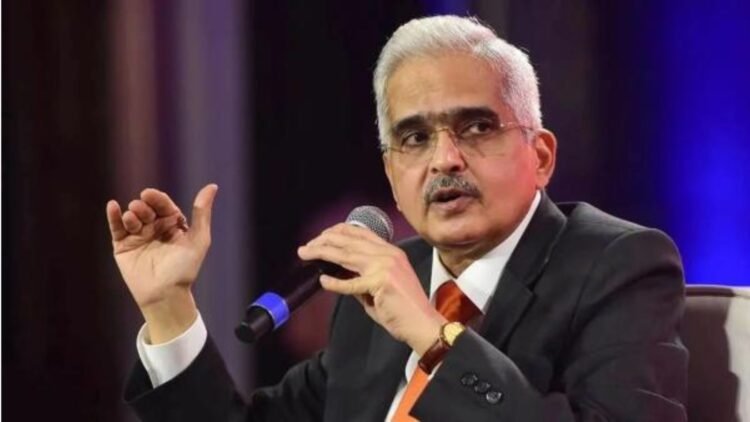

NEW DELHI (Economy India): RBI Governor Shaktikanta Das announced on Thursday that rural demand in India has shown significant signs of recovery. Speaking at the FIBAC 2024 conference, Das emphasized the resurgence of private consumption and investment, as reflected in the recent quarterly GDP figures.

Revival in Rural Demand and FMCG Data

Governor Das highlighted the growing strength of rural demand, drawing attention to data from Fast-Moving Consumer Goods (FMCG) companies. “Private consumption, which accounts for 56 per cent of aggregate demand, has grown at 7.4 per cent, rebounding from a modest 4 per cent in the second half of last year,” said Das. He added, “FMCG data confirms the revival of rural demand.”

Strong GDP Growth Despite Minor Slowdown

The GDP growth rate for the first quarter of FY25 stood at 6.7 per cent, according to the Ministry of Statistics and Programme Implementation. While acknowledging this slight slowdown, Das explained that over 90 per cent of the GDP had expanded as expected. He attributed the deceleration to a reduction in government spending, likely influenced by the ongoing elections and the Model Code of Conduct.

Das urged analysts not to overlook the broader economic performance. “When we talk about the slowdown to 6.7 per cent, we have to remember that the majority of the GDP grew at a robust pace, above 7 per cent. This context is crucial,” he said.

Investment and Private Sector Growth

NEW DELHI (Economy India): Das also identified investment as a key pillar of growth, alongside private consumption. Investment, which makes up 35 per cent of GDP, saw a growth rate of 7.5 per cent. He called for increased private sector investment, noting that credit to industries and Micro, Small, and Medium Enterprises (MSMEs) had grown significantly over the past year.

According to recent RBI data, credit to agriculture and allied activities saw an 18.1 per cent year-on-year increase, while credit to industries grew by 10.2 per cent. MSMEs experienced a 14.4 per cent increase in credit.

Inflation Outlook and Monsoon Impact

On the issue of inflation, Das provided a cautiously optimistic outlook. “There is an expectation that food inflation will become more favorable over the course of the year, but we must remain vigilant,” he said. The governor’s optimism was backed by strong monsoon progress and healthy kharif sowing, which are key indicators for stable food prices.

Governor Shaktikanta Das’s remarks at FIBAC 2024 painted a promising picture of India’s economic recovery, driven by a resurgence in rural demand and robust investment growth. As the economy continues to strengthen, the RBI remains focused on balancing inflation risks and encouraging private sector investment.

Economy India