New Delhi (Economy India): Gold and silver prices witnessed a sharp decline in the futures market on Monday as optimism surrounding a potential US-China trade agreement and a stronger US dollar weighed on precious metal demand.

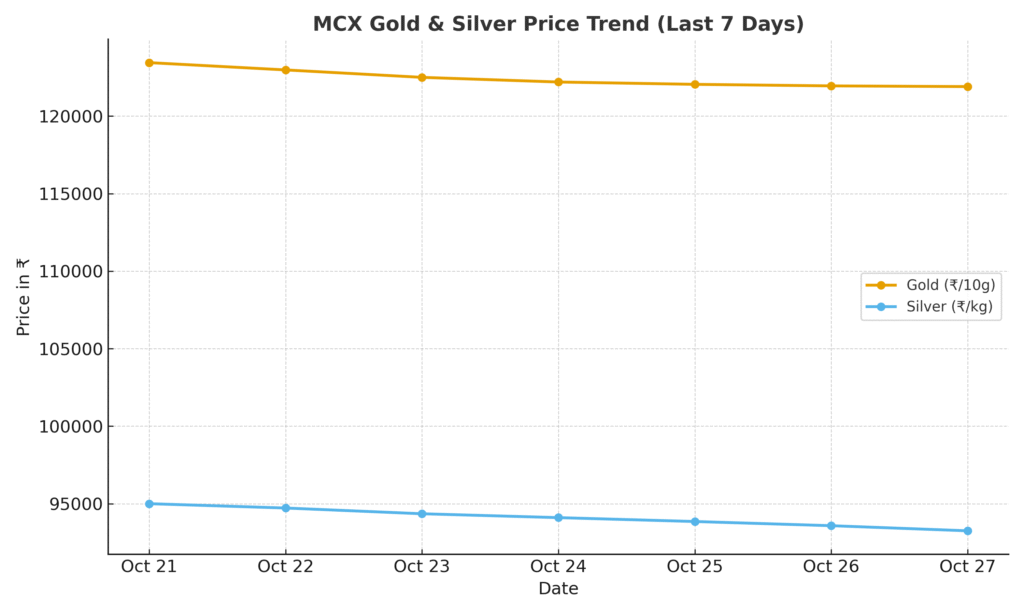

On the Multi Commodity Exchange (MCX), the December gold futures dropped by ₹1,546 or 1.25%, settling at ₹1,21,905 per 10 grams. The contract saw active trading with over 12,428 lots changing hands during the session.

Silver futures also faced downward pressure, following the trend in global markets where investors shifted focus toward riskier assets amid easing geopolitical concerns and a firm dollar index.

Key Market Drivers

- Stronger Dollar: The dollar’s appreciation made gold costlier for holders of other currencies, leading to a fall in demand.

- US-China Trade Optimism: Hopes of a renewed trade deal between Washington and Beijing pushed investors toward equity markets.

- Profit Booking: After a strong rally earlier this month, traders opted for profit booking ahead of global central bank announcements.

Global Trend

Globally, spot gold slipped to around $2,340 per ounce, while silver traded near $27.15 per ounce, marking one of the sharpest intraday declines in recent weeks. Analysts say that if trade negotiations continue to progress positively, gold may test support levels near ₹1,21,000 in the domestic futures market.

Analyst View

“Market sentiment is currently risk-on. A firm US dollar and hopes of de-escalation in trade tensions are putting downward pressure on precious metals. However, any geopolitical uncertainty could bring gold back in focus,” said a senior commodities analyst from a leading brokerage firm.

Outlook

Market experts predict short-term volatility in precious metals, with global economic indicators and the Federal Reserve’s policy outlook likely to set the tone for future price movements.

(Economy India)