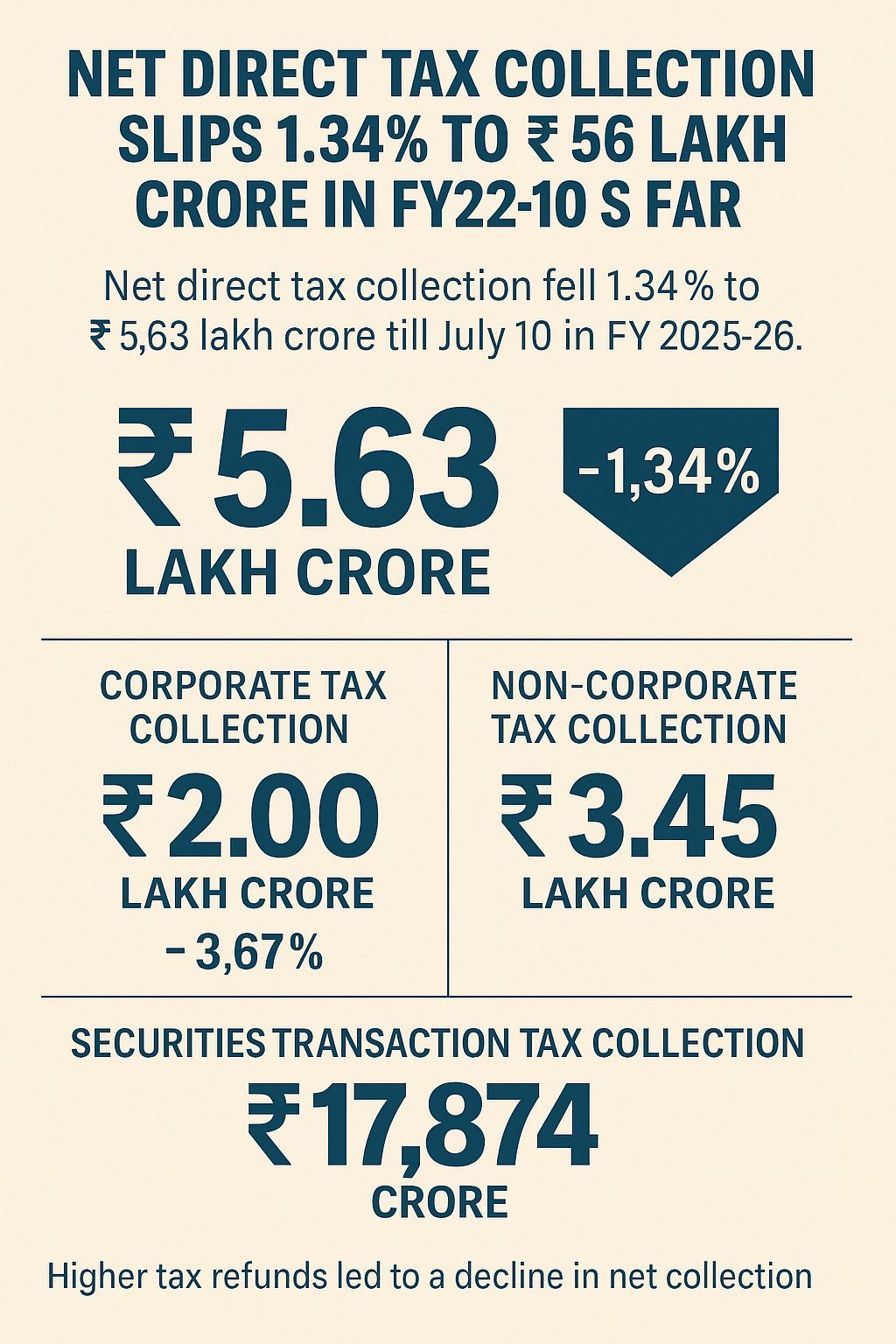

New Delhi ( Economy India): India’s net direct tax collection for the current financial year (FY 2025-26) declined by 1.34% year-on-year to stand at Rs 5.63 lakh crore as of July 10, 2025, according to data released by the Ministry of Finance on Friday. The dip is primarily attributed to higher tax refunds issued during the perio

The net corporate tax collection registered a 3.67% decline, totalling around ₹2 lakh crore, compared to Rs2.07 lakh crore collected during the same period last year. On the other hand, non-corporate tax collections, which include taxes from individuals, Hindu Undivided Families (HUFs), and firms, amounted to Rs 3.45 lakh crore.

Additionally, Securities Transaction Tax (STT) collections between April 1 and July 10 were reported at ₹17,874 crore.

The fall in net tax collections, despite a broader expectation of rising revenues in a growing economy, raises short-term concerns for fiscal management. However, officials suggest that the situation may stabilise in the coming months as refund cycles normalise and advance tax inflows increase.

The gross tax collections figure, which includes refunds, has not been released in this report. Historically, gross collections have shown a more stable upward trend, with refunds causing short-term fluctuations in net figures.

(Economy India )