As India celebrates its 73rd Republic Day, the country’s outlook for economic growth in the current fiscal and beyond remains positive, despite the recent rise in Omicron cases that presented apprehensions of slow economic recovery.

Economists at the global credit rating agency, Fitch Ratings expect India to have a much less severe economic impact this year than it had in 2020 and 2021. “Businesses and households are now better adapted to Covid-related disruptions and the vaccination coverage is much higher than before,” says Maxime Darmet, Economist, Director, Sovereign Enhanced Analytics at Fitch Ratings. Furthermore, he says global evidence so far suggests that the Omicron variant is more benign compared to its predecessors.

The sentiment is echoed by Indian multinational conglomerates including Larsen & Toubro (L&T), which believes the country’s economic revival that began post the second wave of Covid is largely on track. “Hence, the impact on India’s economy may not be severe,” says S N Subrahmanyan, Chief Executive Officer and Managing Director at Larsen & Toubro, adding that they are optimistic about various prospects.

Indian manufacturing major Godrej & Boyce points out that both the manufacturing and services sectors have seen growth with the respective Purchasing Managers’ Indexes (PMIs) indicating increased expansionary movement over the past few months.

“On some parameters, we are now crossing pre-pandemic levels. Growth in exports has also been robust for this year and has exceeded pre-pandemic levels by far,” says Anil G Verma, Executive Director and President at Godrej & Boyce, a flagship company of Godrej Group.

“The trend is likely to continue for the fourth quarter, delivering over $400 billion (Dh1,469 billion) in this financial year.”

Fastest Growing Economy

India is projected to remain one of the fastest-growing major economies in the world, according to multiple international agencies, with the World Bank earlier this month retaining the country’s economic growth forecast at 8.3 per cent for the fiscal year 2021-22.

The Indian government’s own agencies have estimated an even higher GDP growth rate in the current fiscal year – in the range of 9.2 to 9.5 per cent – on the back of strong projected performance of major sectors including services, agriculture, manufacturing, mining, construction and energy.

The Indian economy, along with other global economies, has gone through many tribulations since the start of the pandemic almost two years back. However, the Confederation of Indian Industry (CII) points out that the country’s economic rebound has been sharp post the second wave, and the GDP crossed the pre-pandemic levels in the second quarter (July-September).

“We estimate that FY22 will end up with around 9.5 per cent growth, which is broadly in line with the first advance estimate released by the Central Statistics Office (CSO), which stands at 9.2 per cent,” says Chandrajit Banerjee, Director General, CII.

With digital transformation becoming a critical strategic priority for enterprises, India’s premier trade body of tech industry, NASSCOM highlights that almost every sector of India’s digital economy is witnessing a multi-fold growth trajectory.

Fitch Ratings expects India’s growth in 2022 to largely be shaped by the evolution of the pandemic. Provided that recurrent Covid waves are avoided, growth in Indian economy this year will be buoyed by a strong recovery in the services sector.

“Growth momentum should continue to be solid beyond 2022, at 6.5-7 per cent on average. India should position itself as the fastest-growing large economy in the world in the next five years,” says Darmet.

Aiming a $5-Trillion Economy

Presently pegged at $3.1 trillion based on the current price in dollar terms, India is chasing a target of becoming a $5 trillion economy by 2025, as the government pushes ahead with various economic reforms to drive manufacturing capacity and domestic consumption.

“Our economic growth trajectory will have additional impetus due to the supply chain vacuum caused by the global socio-political changes. India becomes a key natural choice for sourcing and will further attract investments and the opportunity to expand exponentially,” says Ravi Chawla, MD & CEO, Gulf Oil Lubricants India Limited.

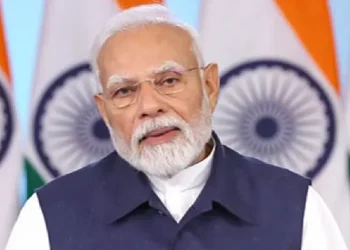

Recognising this opportunity, he says, India’s prime minister Narendra Modi has laid out his vision of a ‘Self-reliant India’ with the Production-Linked Incentive (PLI) scheme, and an increase in infrastructure investment to bolster the industrial demand for lubricants will further enhance private investment outlook, especially in the manufacturing and export space.

“India is poised to become the hub for all manufacturing activities for global requirements and also the focus on infrastructure development augurs well, leading to stronger demand for our products,” adds Chawla.

Subrahmanyan says it is well acknowledged that to grow, India must build and therefore, it is not without reason that the focus of the central government has been to drive infrastructure development.

“Encouragingly, this is occurring across sectors, be it urban infrastructure, roads, railways, bridges, metro rail systems, power transmission and distribution, water infrastructure, hydrocarbon or even defence,” he says, adding that L&T is coincidently involved significantly in all these sectors.

CII acknowledges that recent policy reforms including the reduction in corporate tax rates, focus on reducing regulatory burden, reducing the logistics cost by augmenting logistics infrastructure and the proposed National Logistics Policy, the consolidation of labour laws, will all help build India’s manufacturing sector and the economy at large.

“The measures are expected to help attract FDI as well – especially as they come at a time when global corporations are looking at diversifying their supply chains, creating sectoral champions with scale and competitiveness, and driving job creation and exports in the manufacturing sector,” explains Banerjee.

Positive outlook

Going forward in 2022-23, CII expects the Indian economy to grow at a robust rate of around 8-8.5 per cent, led by a combination of demand recovery owing to high vaccination rates, mobility returning to normal, enabling government interventions and reforms, and better performance of exports of goods and services.

“At the sectoral level, the agriculture sector is doing well, which will support overall growth by strengthening the rural demand,” says Banerjee.

Godrej & Boyce is also optimistic about good growth in the economy for the year ahead and expects a revival of consumption leading to fresh investments in CAPEX. “The government’s Atmanirbhar Bharat policy will also support fresh investments and job creation leading to a further boost to the economy,” says Verma.

Key Drivers of Growth

CII points out that rebound in economic activity in 2022 and resilience of the economic activity against the third wave of covid will also be supported by various initiatives undertaken by the government to address the pandemic fallout.

“Strong investment spending aided by government’s robust CAPEX spending, which is doing the heavy lifting from the demand side, is likely to remain as a growth driver as well,” says Banerjee. A buoyant exports sector will be growth supportive too.

The construction giant L&T, which is closely involved with numerous infrastructure and construction projects, points out that some of the programmes that need to be taken forward to reap immense benefits include the National Infrastructure Pipeline, the National Hydrogen Mission, the Gati Shakti scheme, the Bharatmala Pariyojana, the dedicated freight corridors, the high-speed rail corridor, the north-east development projects, and several more.

“With depth in engineering, sound project management, particularly for large and complex projects, and leveraging digital technologies and off-site manufacturing to improve productivity and speed of execution, we are well placed to ride this rising wave,” says Subrahmanyan. (Gulf News)